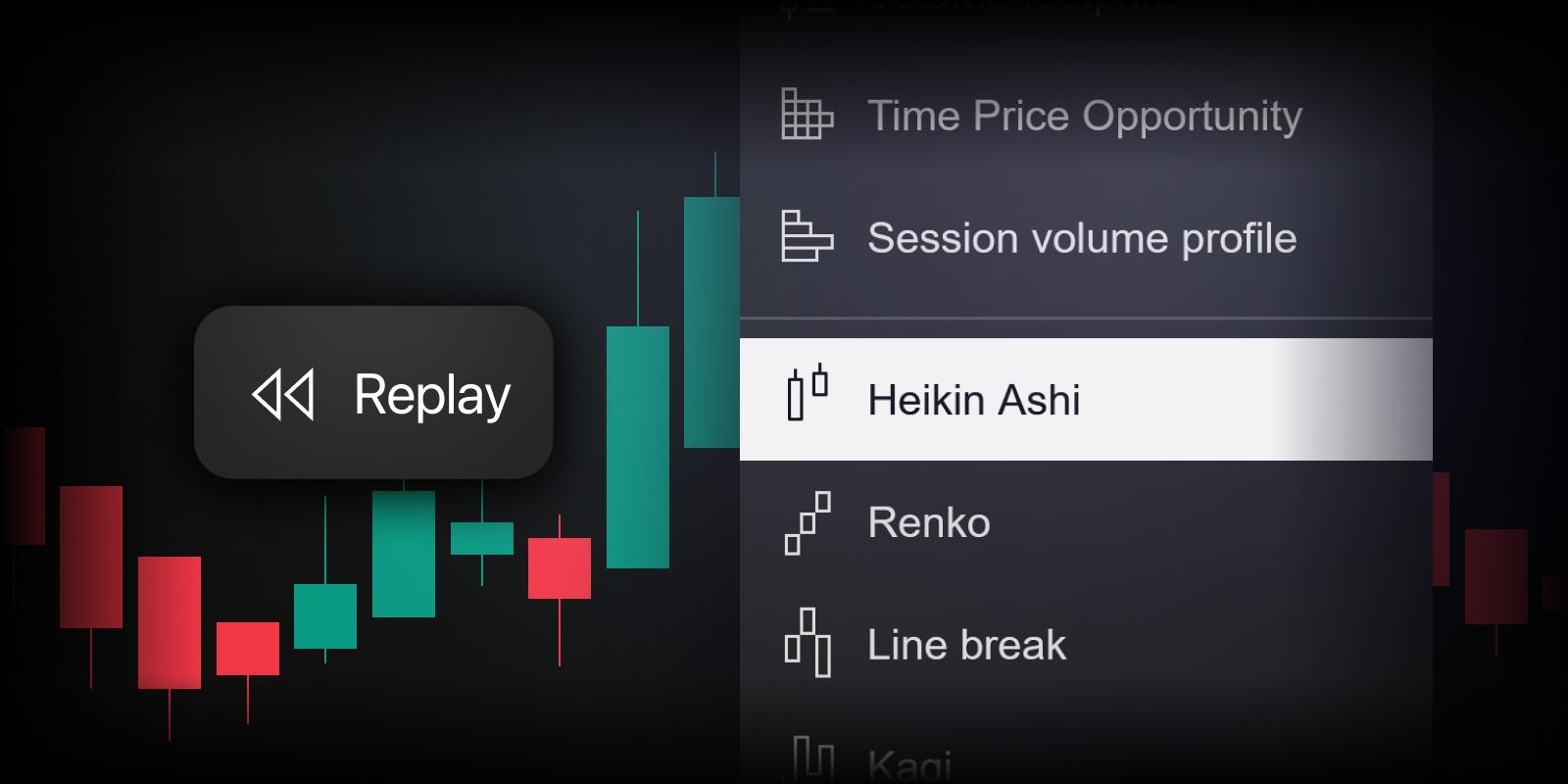

TradingView announced that Heikin Ashi charts are supported in the repetition of the bar.

This upgrade gives merchants an even better way to support the strategies that use the smoother, trend -focused view of Heikin Ashi candles. This combination offers clearer ideas for better negotiation decisions and helps traders to build confidence before living negotiation.

HEIKIN ASHI modified candlesticks provide a cleaner outlook on the market, smoothing price fluctuations. Unlike traditional candlesticks, Heikin Ashi candles (Japanese for “average”) are calculated using average prices that filter market noise and reduce false signals common in volatile conditions. This makes the voltage identification more intuitive, while reversal standards stand out more clearly.

When combined with step -by -step Bar Replay resolution, traders can carefully study how these signals unfold in real market conditions without the pressure of live transaction. The ability to cease and control formations at critical turning points offers an invaluable learning opportunity for both young and experienced traders.

The addition of Heikin Ashi to Bar Replay enhances TradingView’s toolbox for technical analysis and strategy tests, offering traders another way to improve their market approach using historical data. Merchants can compare how strategies perform with the normal tendencies of Heikin Ashi against traditional candles, possibly discover improved entries, better trends identification and more reliable exit signals.

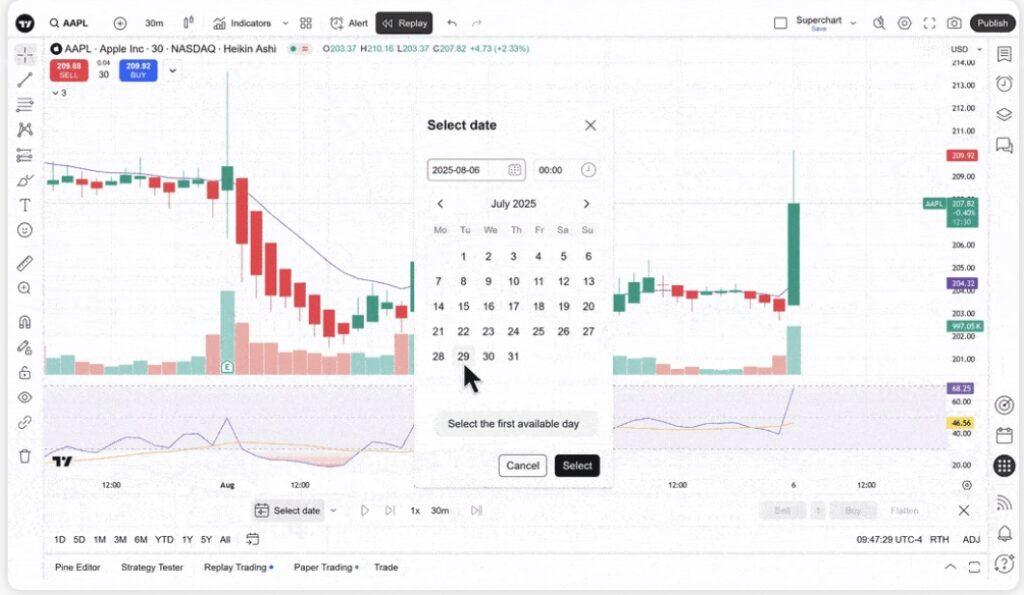

The use of this functionality is simple. Select the Heikin Ashi diagram type, enable the line repetition mode and select any historical period available to analyze.