Global travel money services business Travelex International Group today announced its full year results for the year ended 31 December 2023.

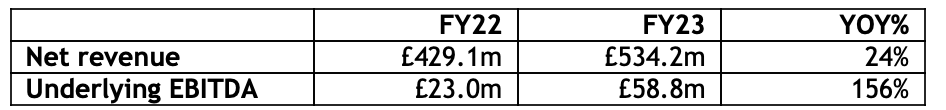

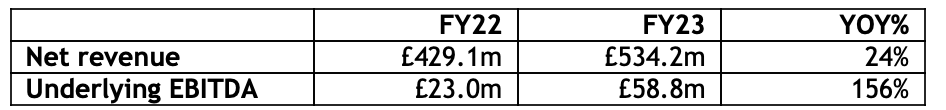

The Group reported underlying EBITDA of £58.8m, representing an increase of £35.8m or 156% in 2022 (£61.3m, an increase of 166% on a constant currency basis).

Full-year revenue rose 24% year-on-year to £534.2m (£541.9m, up 26% on a constant currency basis), with continued growth expected, including increased passenger numbers which are currently approx. 87%. historical levels at the airports in which the Group operates.

Travelex says it is well positioned to deliver further growth across all areas of its business, supported by a number of factors, notably:

- Continued growth in international travel set to surpass pre-Covid-19 levels by 2025, reaching 1.25 billion outbound international travel compared to 1.15 billion in 2019.

- Growth in the travel cash market, which the Group expects to grow by an average of 14% per year between 2022-2028, with spending per visitor increasing.

- Long-term global demand for physical currency, which remains a popular choice for travelers.

The Group is investing in a number of initiatives to continue to drive its future growth. These include an increased focus on the Travelex Money Card (TMC) and app, where there is a significant opportunity to grow Travelex’s share of the overall travel money market by being a one-stop shop for cash and cards. In 2023, Travelex has been very successful in cross-selling TMC to its existing customer base, providing a secure and convenient way for customers to spend with multiple currencies.

There is also scope to expand both retail cash offers and outsourcing into new countries, leveraging Travelex’s international footprint in key travel corridors. In addition, there is strong momentum in banknote wholesale as Travelex continues to gain share in expanding markets, for example in Asia and the Middle East.

As a result, the Group expects to deliver another year of growth in 2024 with underlying EBITDA of between £65m and £75m.