- The formation of a bull flag plan leads the current correction voltage to the uniswap price.

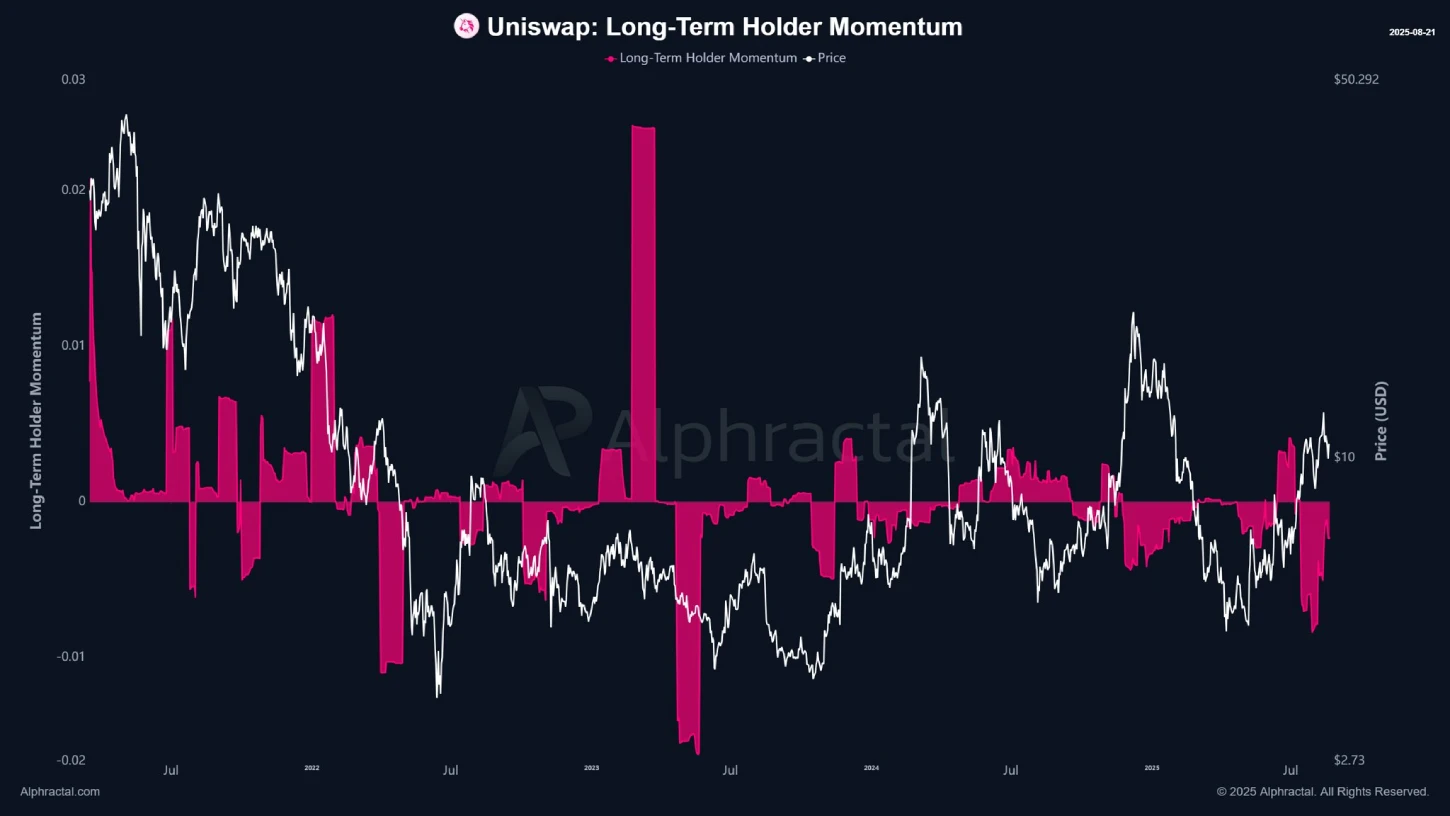

- Uniswap long -term activity (LTH) shows a sharp increase in active supply, indicating a heavy distribution as prices rise.

- Since December 2021, the price of UNI has been in a side trend in a $ 12.3 and $ 4.7 support.

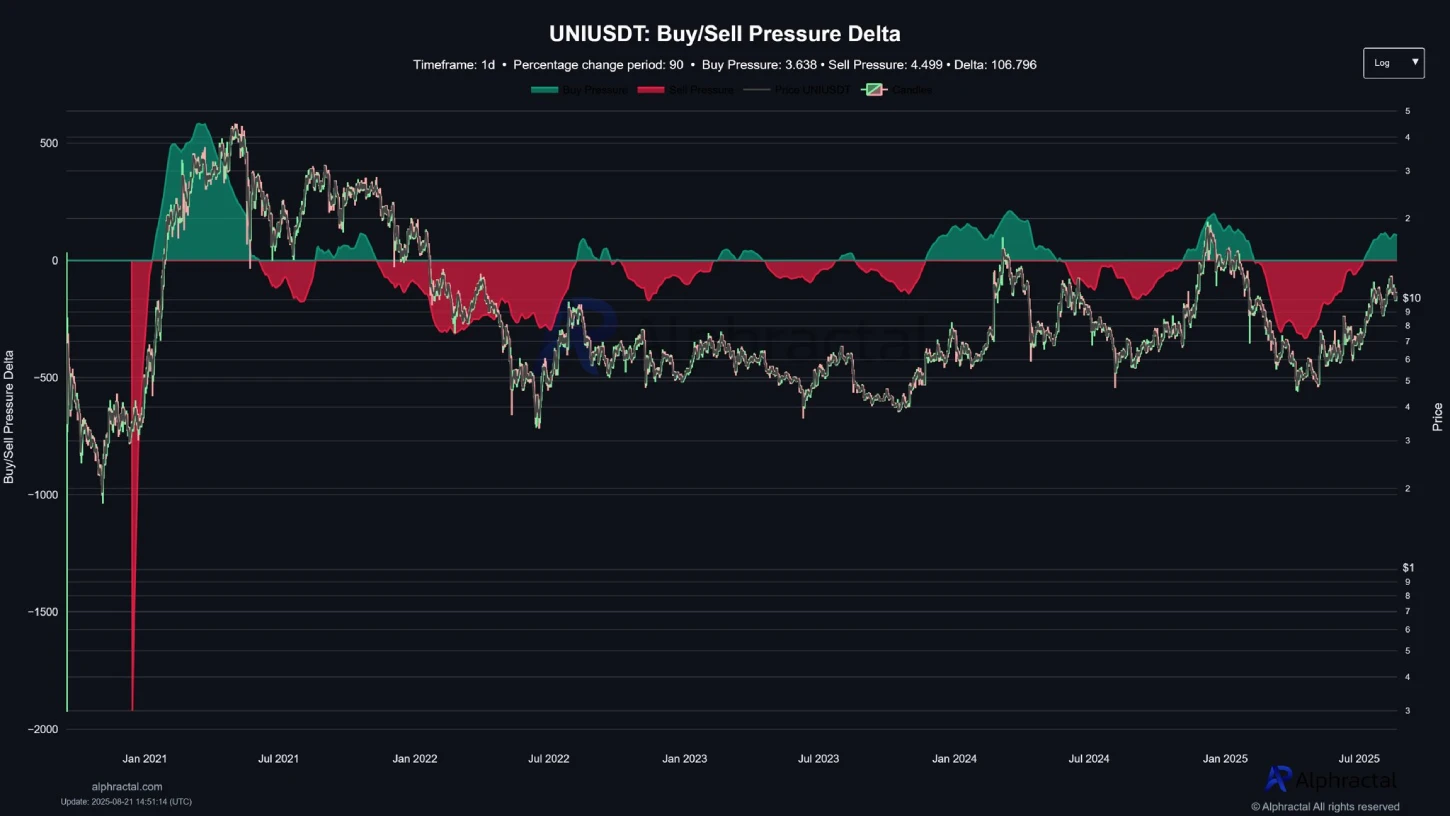

UNI, the inherent encryption of the decentralized Uniswap encryption exchange, sank more than 3% during the US market for trade at 10.3%. Downtict is aligned with a violation of momentum in the broader encryption market, as investors reduce Federal Reserve’s expectations in September. However, sales pressure sites for uniswap price, as long -term owners are actively distributed to a basic level of resistance. Is a distribution under $ 9 a closure, or do buyers have opportunities to compensate?

Heavy LTH distribution increases the risk of prolonged downward voltage to UNI

Last week, the price uniswap showed a V-Top reversal of $ 12.3 at the current $ 10.28 commercial value, recording a loss of $ 16.4%. Subsequently, the ceiling of the asset market fell to $ 6.47 billion. The majority of large cryptocurrencies, including Bitcoin, faced a similar response to investors’ hopes for a September interest rate.

Add to Bearish Note, market analyst Boris He points out why the currency uniswap is struggling to maintain an upward impulse. Since December 2021, Altcoin has negotiated sideways, creating large liquidity positions on both sides. The diagram below shows a significant brief clearance cluster at $ 13.5 and a long clearing zone close to $ 8, creating a basic level of rotation for traders.

Along with the recent market recovery, the price of Uniswap recorded increased demand pressure, enhancing the possible unblocking of the asset. However, chain flow suggests that big players are likely to unload positions through marginal orders, creating a strong resistance near recent peaks.

Common analysis highlights a remarkable increase in the active supply of long -term holders, marking a heavy distribution tendency as prices increase higher. This feeling of output is common in an upward trend, marking the risk of prolonged fall.

Meanwhile, the activity of short -term holders (STH) shows that investors have again introduced the local peak, signaling a short -term peak. The market is now entering a pressure test for SHS, with a correction possible as speculative positions.

If this trend continues, the price of uniswap could fight to keep its place above the 10 dollar floor.

Uniswap Price Eyes Bear Breakout inside the flag pattern

The 4 -hour analysis of the unicoin value diagram shows that the current tendency to correct it strictly resonates in converging trends of a pattern of bulls. The price of the coins bounced at least three times by the motif of resistance and four times from the lower voltage to create its strong influence on price orbit.

The diagram regulation is characterized by a long rising voltage called “pole” that indicates the dominant voltage in the price, followed by a temporary correction within the converging trends to recover the existing convenient momentum.

The currency price is placed above the exponential average of 100 and 200 days (EMA), indicating a wider tendency to launch. Despite completion of the sale, Uni Coin price is less than 1% smaller than a Bullish Breakout by Overhead Trendline

Thus, a possible unblocking will accelerate the market pressure to the price and set a possible increase to $ 12.3, signaling an increase of almost 20%.

However, if market selling pressure insists, the price of the coins could face another reversal in the flag formation and lead a prolonged under $ 9.5.

Also read: Will Solana Price Break Lower by the end of August?