Virtu Financial, Inc. (NASDAQ:VIRT), a provider of financial services and products that leverages cutting-edge technology to deliver innovative, transparent trading solutions to its clients and liquidity in global markets, today announced results for the second quarter ended June 30, 2024.

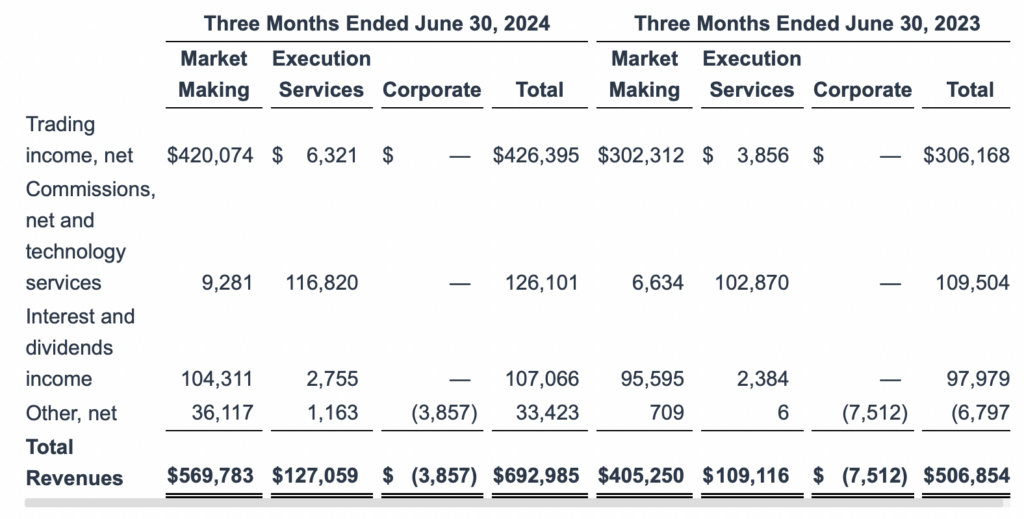

Total revenue rose 36.7% to $693.0 million for the second quarter of 2024, compared to $506.9 million for the same period in 2023.

Net trading income rose 39.3% to $426.4 million in the quarter compared to $306.2 million in the same period in 2023. Net income was $128.1 million for the quarter, compared to net income of $29.5 million in the year-ago quarter.

Basic and diluted earnings per share for this quarter were $0.71, compared to basic and diluted earnings per share of $0.16 for the same period in 2023.

Adjusted net trading income increased 38.2% to $385.1 million for this quarter, compared to $278.7 million for the same period in 2023. Adjusted EBITDA increased 78.3% to $217.5 million dollars for this quarter, compared to $122.0 million for the same period in 2023 Normalized. Net Income, excluding non-recurring and non-cash items, rose 119.2% to $135.3 million for this quarter, compared to $61.7 million for the same period in 2023.

From the start of the share repurchase program in November 2020 through the settlement date of July 12, 2024, the company repurchased approximately 47.2 million shares of Class A Common Stock and Virtu Financial Units for approximately $1,181.4 million.

Including the additional authorization of $500 million by its Board of Directors on April 24, 2024, the Company has approximately $538.6 million of remaining capacity for future purchases of Class A Common Stock and Virtu Financial Units under the program.