- The price of Ethereum shows a decisive unblocking from the symmetrical triangle pattern, resulting in a 48 -month accumulation.

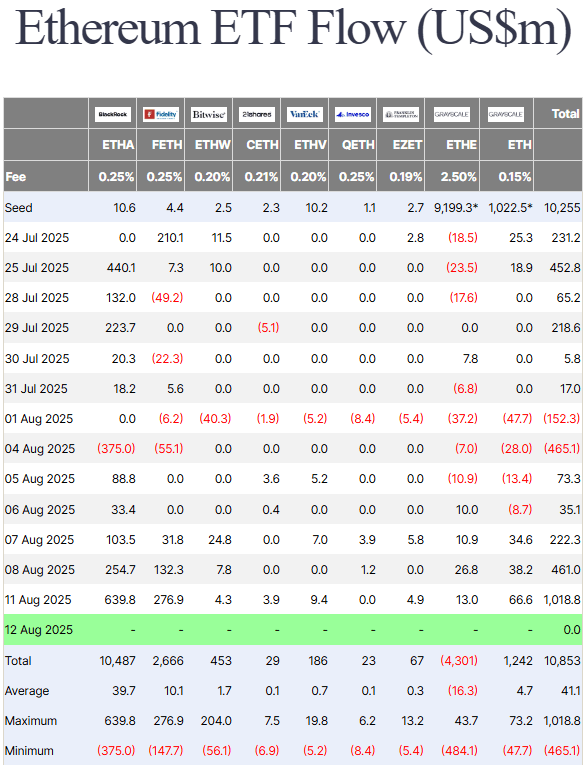

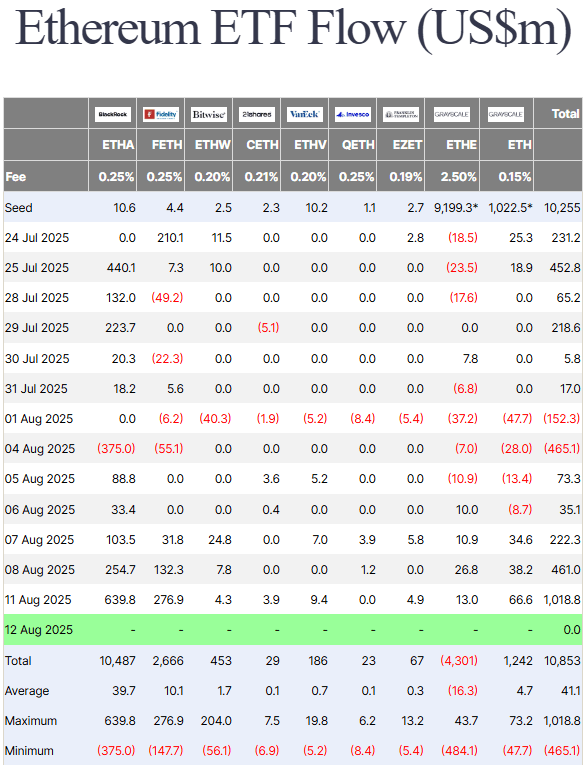

- On August 11, 2025, the ETF ETF recorded a massive influx of more than $ 1,018 billion, signaling intense demand pressure on Ethereum

- Bitmine, a Treasury Ethereum company, has announced a significant increase in the total amount of the common shares it plans to sell, increasing the ceiling to $ 24.5 billion.

ETH, the inherent encryption of the smart giant Ethereum contract, witnessing a sharp jump of 6.14% to market $ 4,445 today. At the same time, the ceiling of the ETH market bounced to $ 536.54 billion, while the 24 -hour volume increased by 16% to ranging to $ 49.04 billion. With the intraperite increase, the currency has only 9% smaller than the high degree hit at $ 4,891.70.

Below are three main reasons why the price of Ethereum is today. Will this recovery continue?

ETH demand increased with $ 1.02 billion in Etf Spot Etf Input

In the last two months, the price of Ethereum has been high rally of $ 2,115 at the current commercial value of $ 4,487, recording an increase of 112%. An important contributor to this rally is the aggressive influx of money trading in ether (ETFS).

On August 11, 2025, the US -based Spot ETF ETF recorded the largest day of their net inputs, with flows in all chapters together with a total of about $ 1,018 billion.

According to Farside investorsBlackRock ETF (ETHA) Ishares Ethereum Trust attracted the lion’s share of $ 639.79 million. The Fidelity Ethereum Fund (FETH) was the runner -up, recording a significant influx of $ 276.9 million.

Enthusiastic etherum Anthony Sassano It was registered on Tuesday that the ETFs of Ethereum bought more than 50% of all ETH purely issued from the merger in late 2022.

Blockchain has issued more than 451,079 ETH from its transition to proof, while ETF ETFs during Monday’s negotiation saw a total influx of more than 238,200 ETH.

This lack of demand greatly enhances the ETH price for a prolonged recovery.

Also read: Bitcoin is increasing over $ 121,000 after sinking under $ 113,000

Institutional support for Ethereum is increasing as Bitmine increases the $ 24.5 billion sales ceiling

Another factor that enhances the tendency to recovery at ETH price is institutional adoption. Just recently, Treasury Ethereum, Bitmine, announced An important update in its latest complementary newsletter.

The company has revealed that they significantly increase the total amount of shares it plans to sell under the existing sales agreement, increasing the ceiling to $ 24.5 billion. The revised figures include $ 2.0 billion in the original newsletter and $ 2.5 billion as part of the previous newsletter supplement. In addition, Bitmine is trying to add an additional $ 20.0 billion to the latest newsletter supplement.

Information marks strong confidence in the development potential of ETH by institutional factors.

According to Coingecko data, Bitmine currently holds 1,150.263 ETH (worth $ 5.17 billion) with an average price of $ 3,644.

The price of Ethereum exits a 48 -month accumulation tendency

On August 8, 2025, the recovery of Ethereum prices provided a significant unblocking from the upper limit of the symmetrical candle pattern. Since November 2021, the price of Ethereum has been actively echoing within the two converging trends of this motif, leading an important accumulation zone for buyers.

With the recent unblocking, the currency marks the growing dominance of buyers and the possibilities for a continuing price recovery. A steep slope upwards of the daily exponential mobile average (20, 50, 100 and 200) enhances the optimistic feeling in the market.

With a prolonged market, the ETH price is likely to go over 8.3% and challenge the high resistance of all time worth $ 4,875.

However, if the pattern is in place, the currency could lead an extensive target of $ 7,330.

Also Read: Price Rangs Sui 16% Fall If EMA 200 Day Support fails