- The Solana price is ready for a distribution below $ 175 amid the formation of a head and shoulder standard.

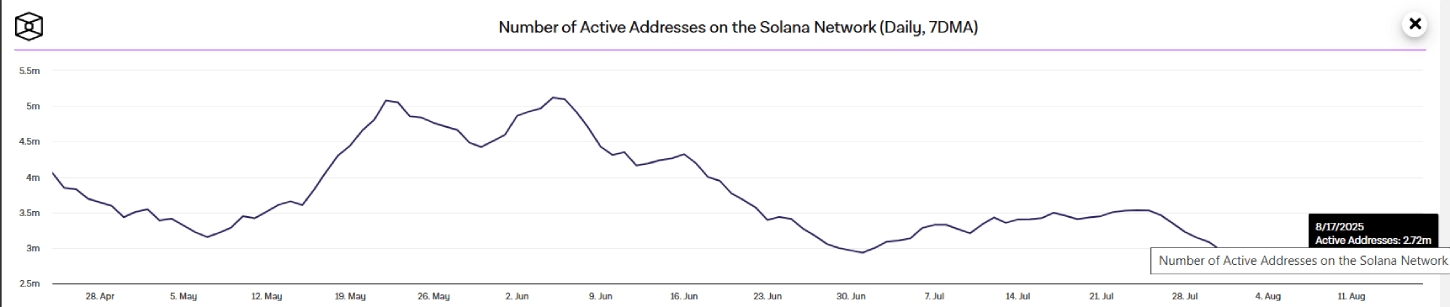

- The number of active addresses on the network decreased by 7% since last week, indicating a clear slowdown in users’ activity.

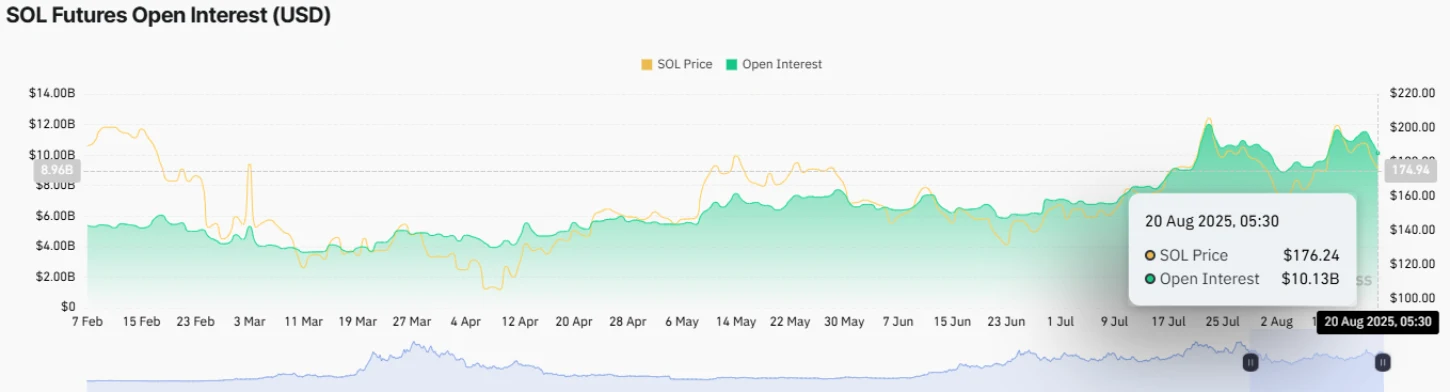

- A declining trend in SOL’s Futures Open Resectres records 13% amidst the recent market correction, marking a reduced interest from market participants.

The Solana price shows a sharp recovery of more than 4.7% during US market hours for $ 184.4. The purchase pressure came as a relief rally in the wider encryption market after a sharp correction since last week. The descending trend in Sol Futures Open Interest (OI) and the number of active addresses on the network feeds the prevailing momentum in price, signaling the risk of Bearish Breakdown in front. The formation of a diagram technical design in the daily diagram reveals how low the currency price could sink by the end of August.

Solana price is reduced as a network activity and the reduction of OI in parallel

Since last week, the Solana price has shown a brief correction of $ 209.86 to a low of $ 175.6, representing a loss of 16.28%. Pullback followed a broader market correction as Bitcoin fell under the floor of $ 115,000 among US macroeconomic developments.

Along with the correction of prices, the No. of active addresses About Solana’s dives from 2.91 million to 2.72 million, showing a 7%loss. Active addresses reflect user participation in the network, including transactions and interaction with decentralized applications.

Thus, the current decline suggests that fewer users are dealing with Solana during the rebellious price, showing reduced trust or short -term lack of interest.

Simultaneously, Futures Open Interest Sol It has fallen from $ 11.65 billion to $ 10.13 billion, recording a 13%drop. A Wipeout $ 1.52B in the OI signals that traders are closing their open seats in the future market or clearing.

This is often the case after an increased variability, where leverage positions are forced to liquidate and reduce total speculative pressure.

The double decline of OI and active addresses indicate that both speculative traders and network participants are returning. If the voltage continues, the price of coins could deal with additional impulse to drive a prolonged correction.

Adding to the Bearish Note, a encryption wallet recognized as ’91gshr’ UNSTAKED 98,291 SOL (worth about 17.83 million dollars) and deposited all this in Binance Exchange just 30 minutes after Look reported.

At the risk of possible sale, a Bearish bias from big investors could further supply market selling pressure.

Solana price is ready for prolonged correction from this reversal pattern

In the daily diagram, the last recovery of SOL prices resulted from the $ 117.5 -dollar support of an inverted head and shoulder pattern. The diagram adjustment is characterized by three consecutive cavities, with the middle one extensive high and two short swings.

It is currently negotiating at $ 184, the Solana price is likely to form the final right shoulder of this pattern before the throat is destroyed. If sellers manage to keep the asset below $ 187.30 resistance, sellers could force a Bearish distribution of $ 175.00 support, accelerating the sale pressure.

Falling after stopping could push the price of 11.5% to test a basic level of support to $ 155.77. The aforementioned support coincides with a long -standing trend that has acted as dynamic support since April 2025.

The previous upheavals of this support led to a price ranging ranging from 67% to 97%. Thus, the expected drop to $ 155.77 could act as a rotation point for the Solana price to change the current trend direction.

On the contrary, if the current price dissolves over 187.3 resistance, buyers could regain control of the asset for higher rally.

Also Read: Will the SUI $ 3 Price Correction Floor break?