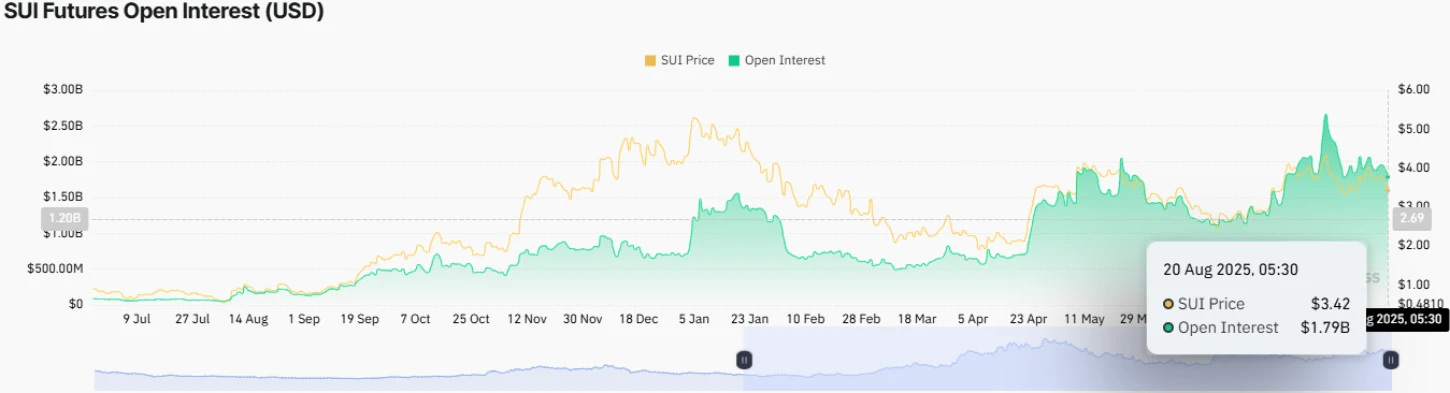

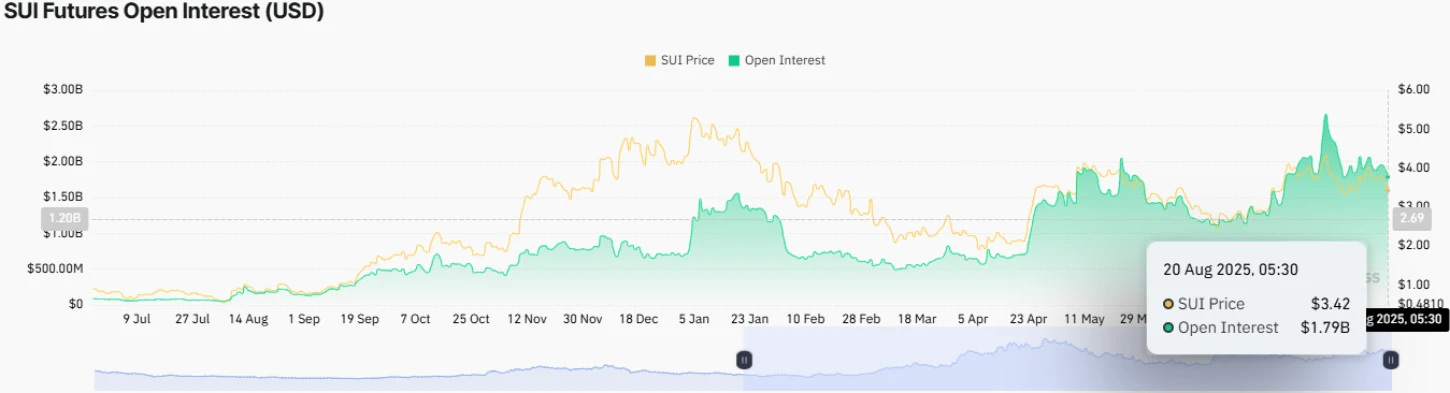

- A sharp drop in Sui Futures Open Interest (OI) reflects reduced investors in the midst of market uncertainty

- A bull -flag pattern leads the current correction voltage to sui.

- The $ 3.14 floor, which coincides today with the 200 -day EMA, provides a high interest rate (AOI) for traders.

The Sui price shows 5.1% during Tuesday’s purchase hours to negotiate today at $ 3.45. The sale pressure is aligned with Bitcoin’s pullback below $ 115,000 amid macroeconomic growth in the US market. However, the Sui currency faces additional mixing momentum between the feeling of a “sell-news market, after the Robinhood directory and the declining trend in future open interest. Will the correction voltage push this Altcoin below the floor of $ 3?

The activity of derivatives falls as Sui OI has contributed to $ 1.79B

In the last three weeks, the Sui price shows a remarkable correction of $ 4.44 at the current commercial value of $ 3.43, showing a loss of $ 23.16%. Subsequently, the ceiling of the asset market has been immersed at $ 12.13 billion. Bearish dynamics deepen the Tuesday market hours, as traders participated in receipt of profits after the short -lived boost from the Robinhood list.

Through the price response, the Sui Futures Open Interest (Oi) It has also plunged $ 2.66 billion to $ 1.79 billion, representing a decrease of 32%. The contraction at OI reflects a sharp decline in speculative activity as traders close their open market positions to support significant instability.

Historically, such a sharp drop in price oi indicates a speculative cooling phase for buyers to regain the exhausted momentum.

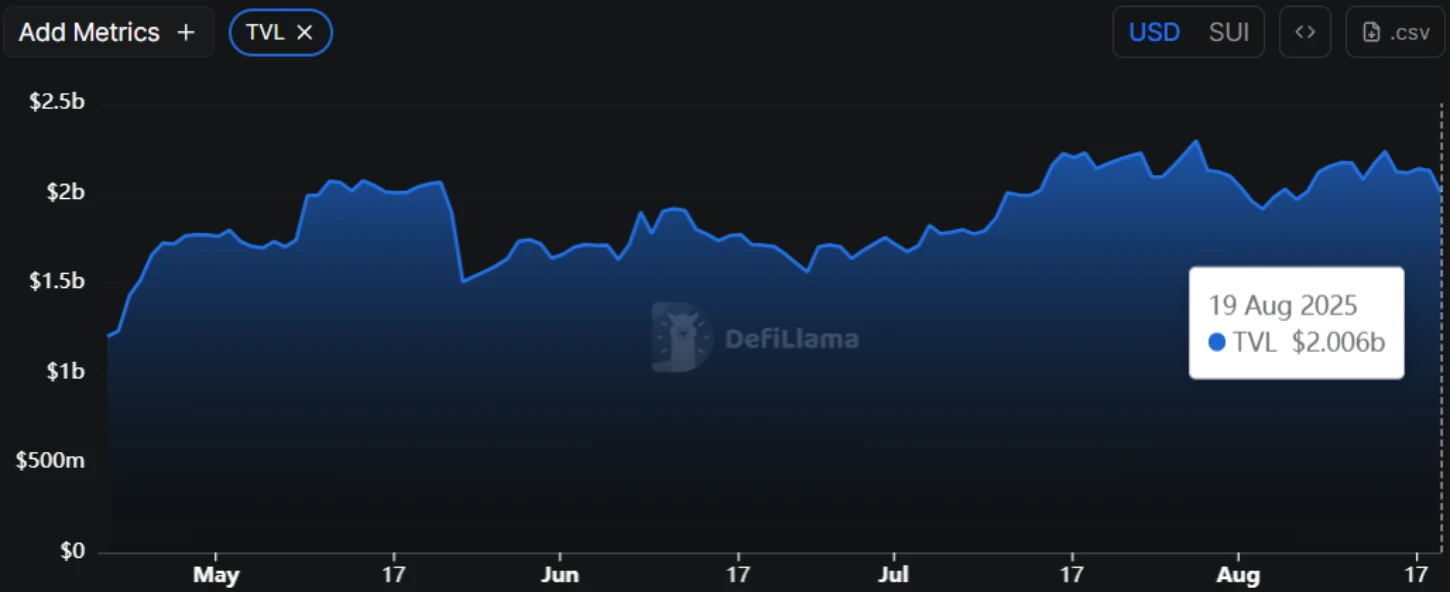

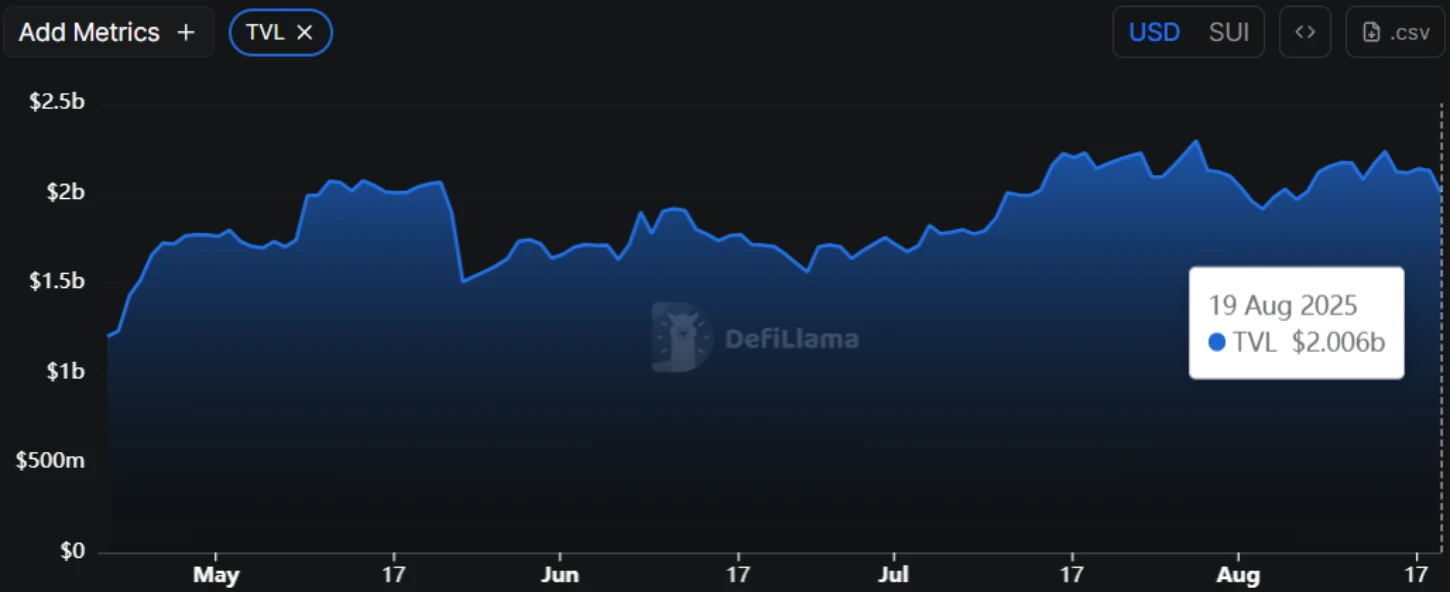

At the same time, the The total volume locked (TVL) on the Sui network also decreased from $ 2.13 to $ 2, with a loss of 6.13%. This fall in TVL shows that investors are gradually pulling liquidity from the Sui Defi ecosystem.

A steady weakness in TVL could weigh the sui growth prospects. If the voltage continues, the currency value could face additional pressure and lead a prolonged drop.

Also, read: The price of Chainlink defies the market market with the confidence of whales. 30 $ jump then?

Sui price for a large flag -forming support test

The analysis of the sui prices of the daily time frame shows that the current correction voltage resonates within the bull flag formation. The diagram adjustment is characterized by a long rising voltage, reflecting the dominant voltage in the price, followed by two converging trends to lead a brief correction to force the momentum.

The flag pattern is usually located in an established upward trend as it allows buyers to restore the exhausted convenient momentum before the next jump. The price of the currency bounces at least twice from the two voltages of the motif and validates its credibility to affect future voltage movements.

The $ 3.44 signal is currently being traded, the Sui price is just 5.5% from the challenge of the voltage of the minimum standard at $ 3.14. With the broader market correction and the reduction of voltage in the future market, sellers reinforced their handle over this asset. A Bearish distribution below the support voltage will accelerate the sale pressure and lead a prolonged correction of over 11% to hit $ 2.83, followed by a dip on the floor of $ 2.64.

The $ 3.14 signal is currently aligned with the 200 -day exponential average (EMA), creating a basic level of rotation for this asset. If buyers manage to keep this support, the flag pattern will continue to develop and lead a possible vibration of price to the airspace.

A possible unblocking of the flag resistance will mark the continuation of the dominant recovery trend and support an enlarged increase of over 15% to hit the $ 4.4 target.

Also read: Blockchain Lender Figure Technology Files for 400 million $ ipo