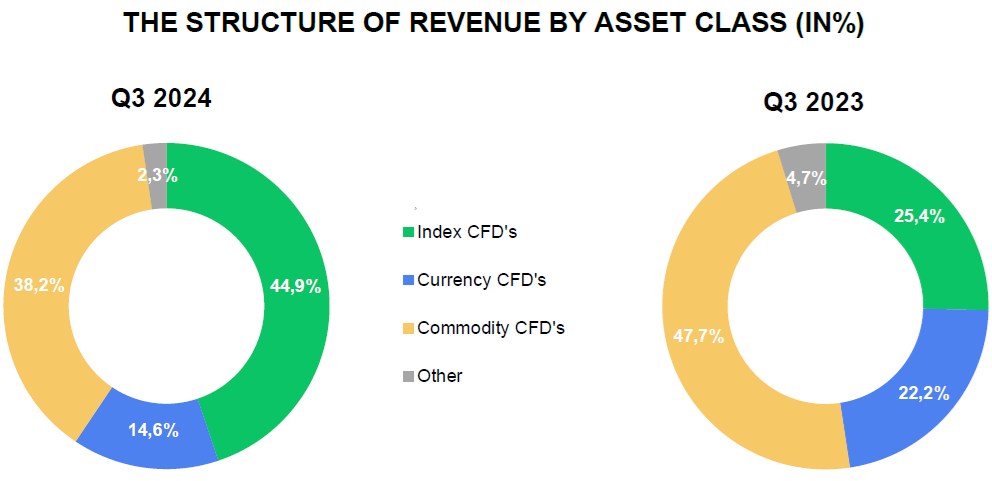

After a disappointing Q2, Poland-based Retail FX and CFDs broker XTB (WSE:XTB) announced its preliminary results for the second quarter of 2024, indicating a good recovery in the third quarter of the year, although activity ( and profitability) did not return to record Q1 levels.

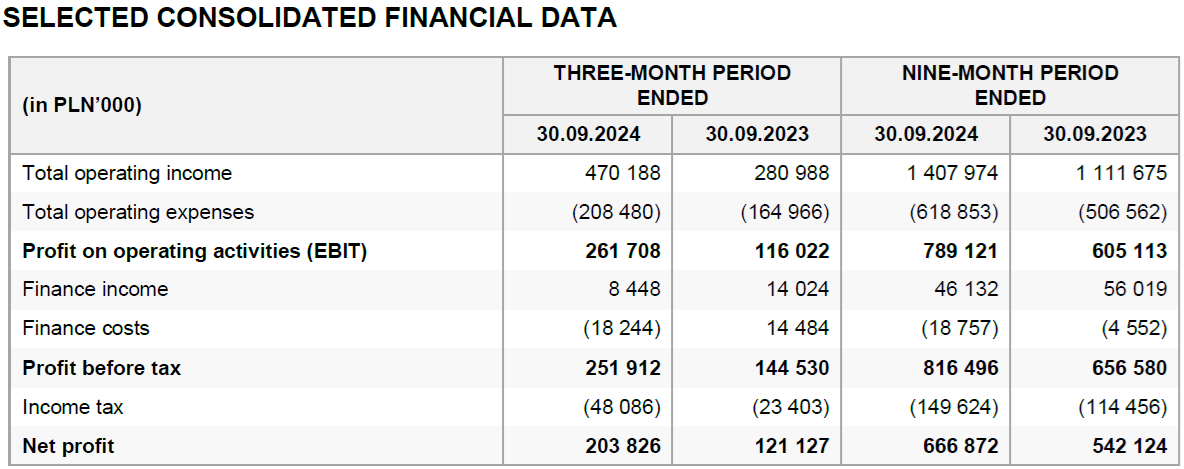

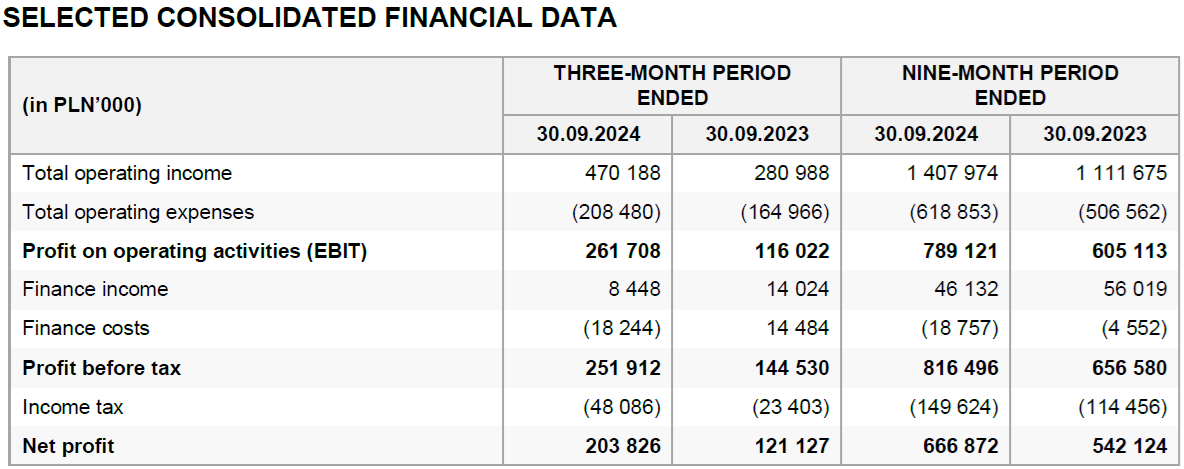

XTB Income and Profits

XTB’s revenue for Q3 2024 was PLN 470 million ($118 million), up 23% from Q2’s $96 million. Net profit rose 27% QoQ to PLN 204 million ($51 million), versus $40 million in the second quarter.

The results were released after the company’s shares closed for trading on Wednesday, so it will be very interesting to see how they trade on Thursday morning. XTB shares fell more than 10% in early September after it was reported exclusively here at FNG that XTB shareholder Jakub Zablocki had redeemed $135 million worth of shares in a secondary offering, reducing his stake in the company below 50 % for the first time.

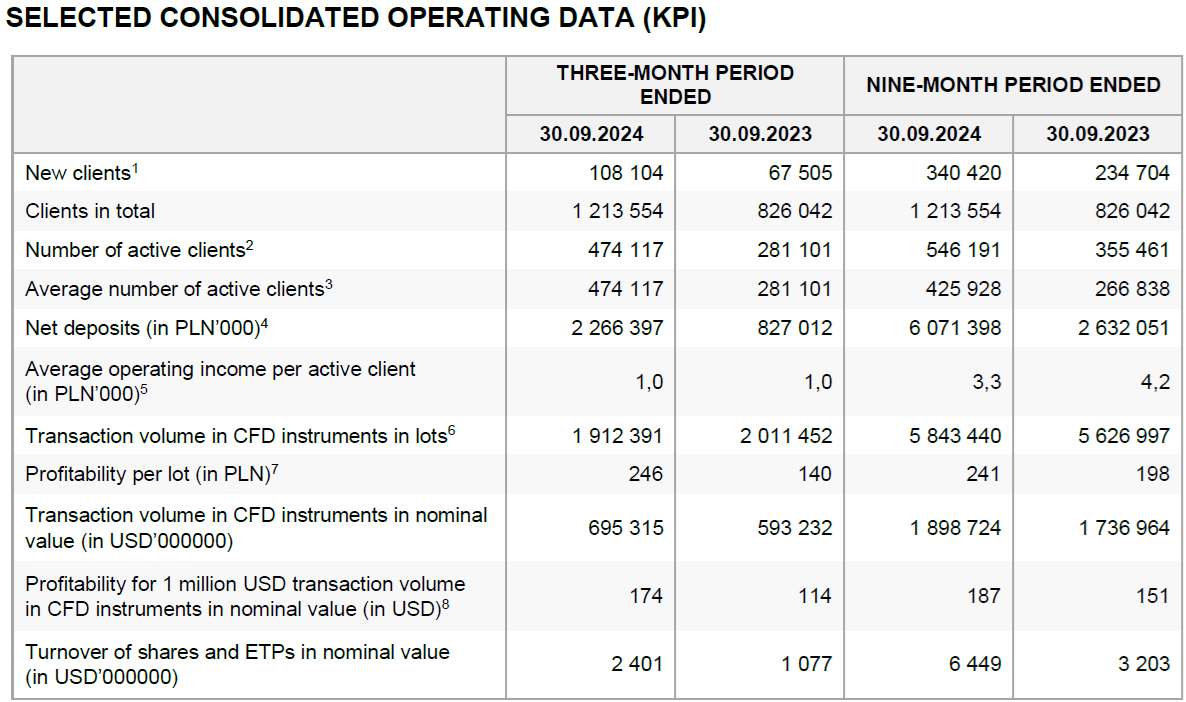

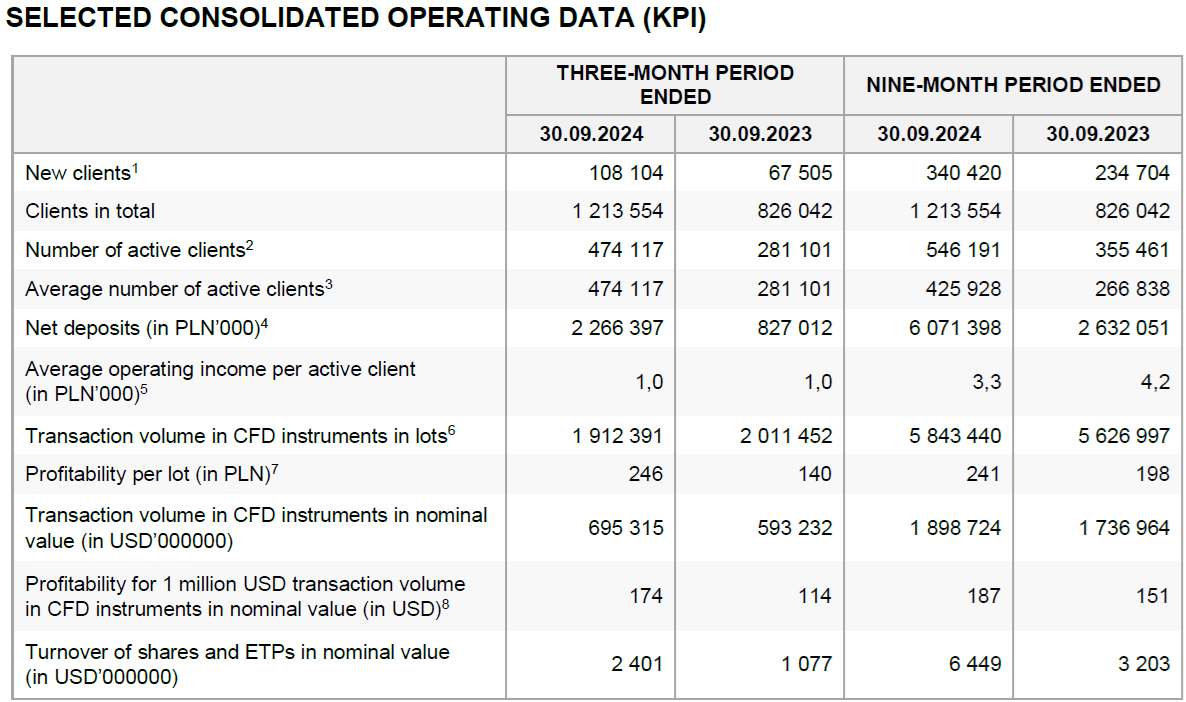

XTB trading volumes

Trading volume on XTB averaged $232 billion per month in the third quarter of 2024, up 12% from $207 million per month in the second quarter of 2024. The company’s earnings per $1 million in trading volume in the third quarter also rose to 174, up from 154 in the second quarter.

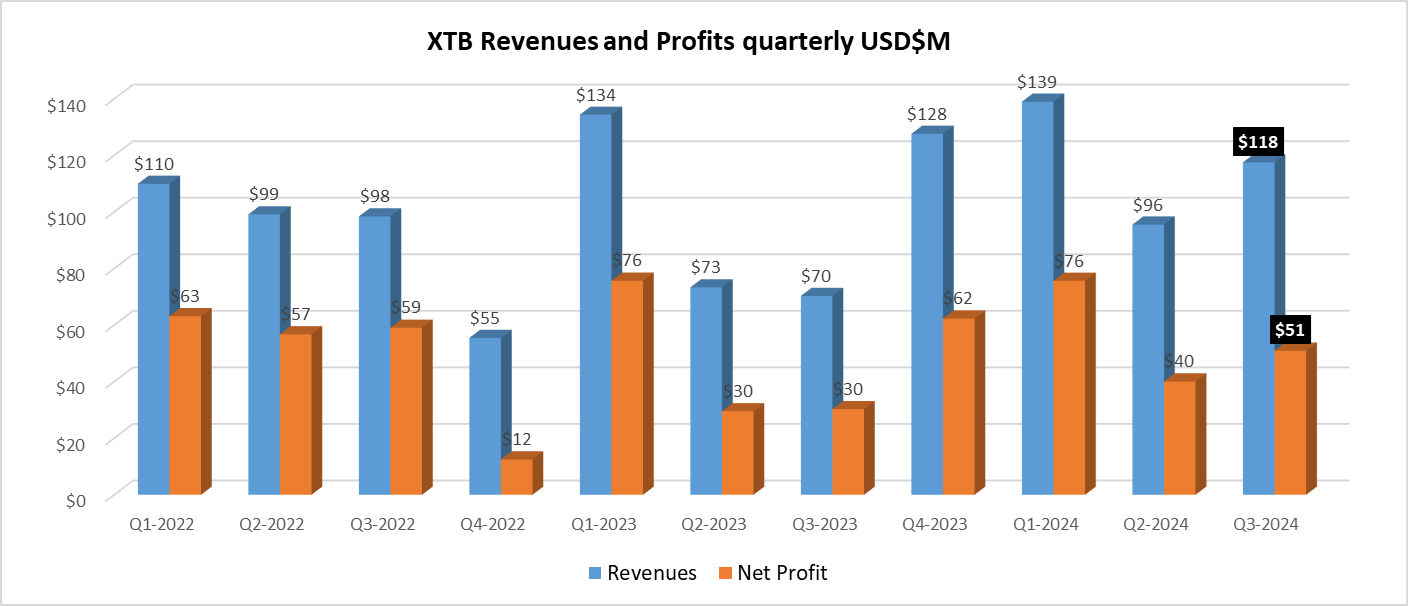

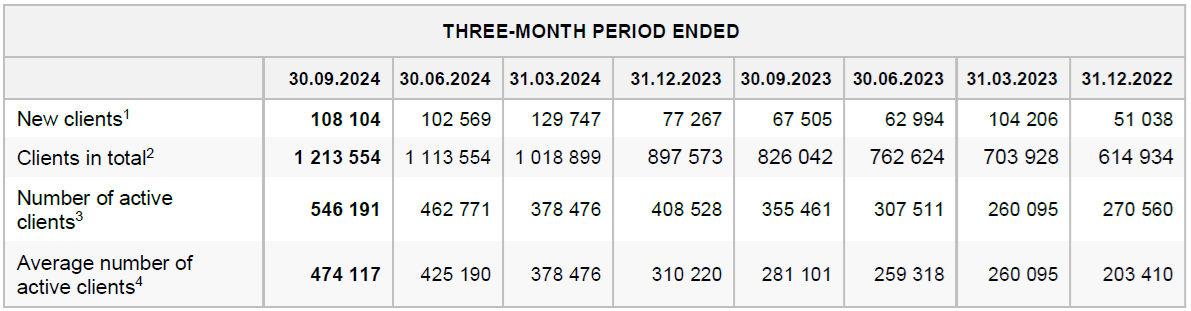

XTB customers

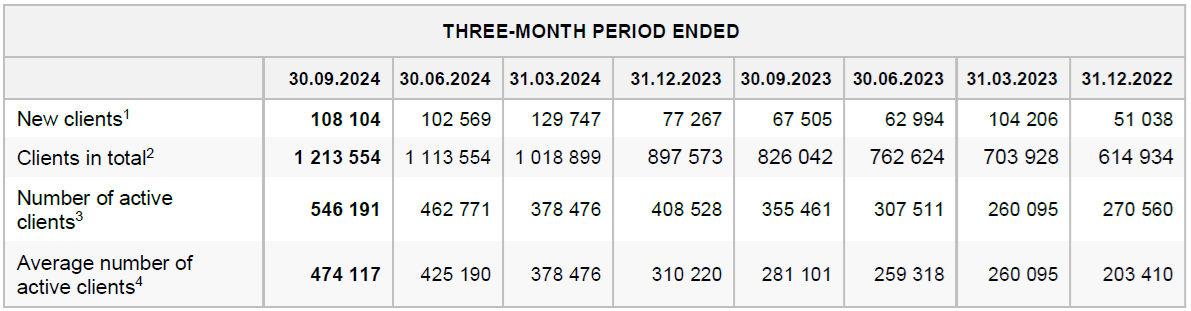

In terms of customers and customer acquisition, in the third quarter of 2024 XTB acquired 108,104 new customers compared to 67,505 a year earlier, an increase of 60.1%. The number of active customers was at a record high during Q3 2024, rising from 281,101 last year to 474,117, an increase of 68.7% year-on-year.

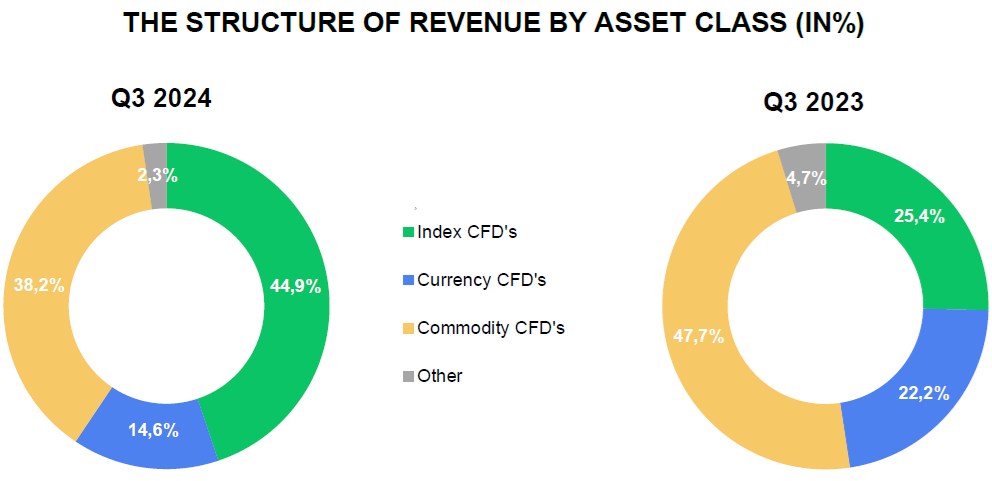

XTB tradable asset classes

Looking at XTB’s revenue by asset class traded, in the third quarter of 2024 index-based CFDs led. Their share in the revenue structure in the period was 44.9% (Q3 2023: 25.4%). This is a consequence of the high profitability of CFDs based on the US 100 index, the German stock index DAX (DE40) and the US 500 index. The second most profitable asset class was CFDs based on commodities. Their share in the income structure of financial instruments reached 38.2% against 47.7% a year earlier. This is a consequence of the high returns of CFDs based on gold, natural gas and oil prices. Revenue from currency-based CFD instruments accounted for 14.6% of total revenue, compared to 22.2% in the previous year. The most profitable financial instruments in this category were CFDs based on Bitcoin cryptocurrency, EURUSD currency pair and Ethereum cryptocurrency.

XTB expenses

XTB’s operating expenses in the third quarter of 2024 amounted to PLN 208.5 million, PLN 43.5 million higher than in the corresponding period of the previous year (Q3 2023: PLN 165.0 million). The most important changes were:

- salaries and employee benefits, an increase of PLN 16.1 million, mainly due to an increase in the number of employees;

- marketing costs, an increase of PLN 13.0 million, mainly due to higher spending on online marketing campaigns, which included the launch of a new marketing campaign starting in September 2024, focusing on the new brand ambassador Zlatan Ibrahimović.

- commission costs, an increase of PLN 10.1 million, as a result of higher amounts paid to payment service providers through which customers deposit their funds into trading accounts; and

- other external services, an increase of PLN 4.3 million, mainly due to higher costs for IT systems and licenses (an increase of PLN 4.2 million per year).

Due to XTB’s dynamic growth, the board estimates that the total cost of operations in 2024 could increase by approximately one-fifth compared to the level seen in 2023. The board’s priority is to continue to grow the customer base and create a global brand. As a result of the activities implemented, marketing expenses may increase by approximately one fifth compared to the previous year.

More highlights from XTB’s Q3 2024 results follow below.