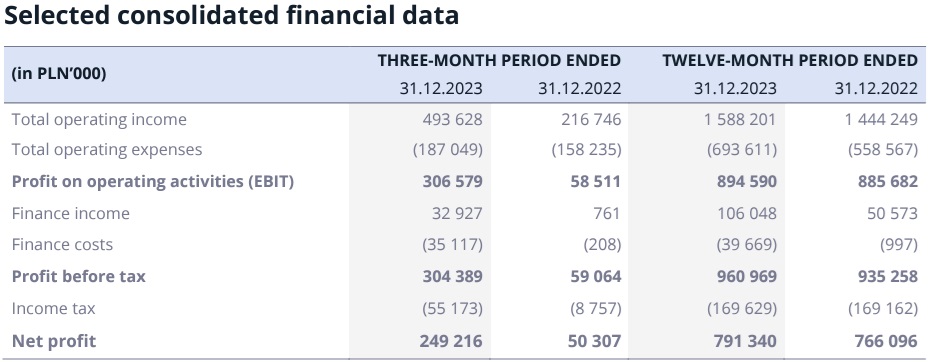

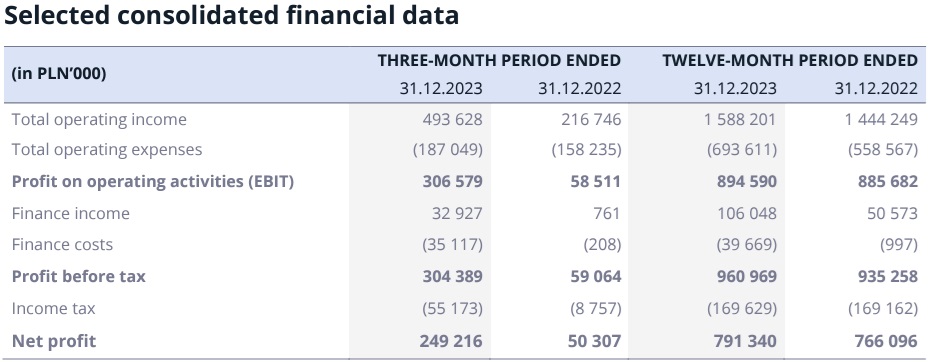

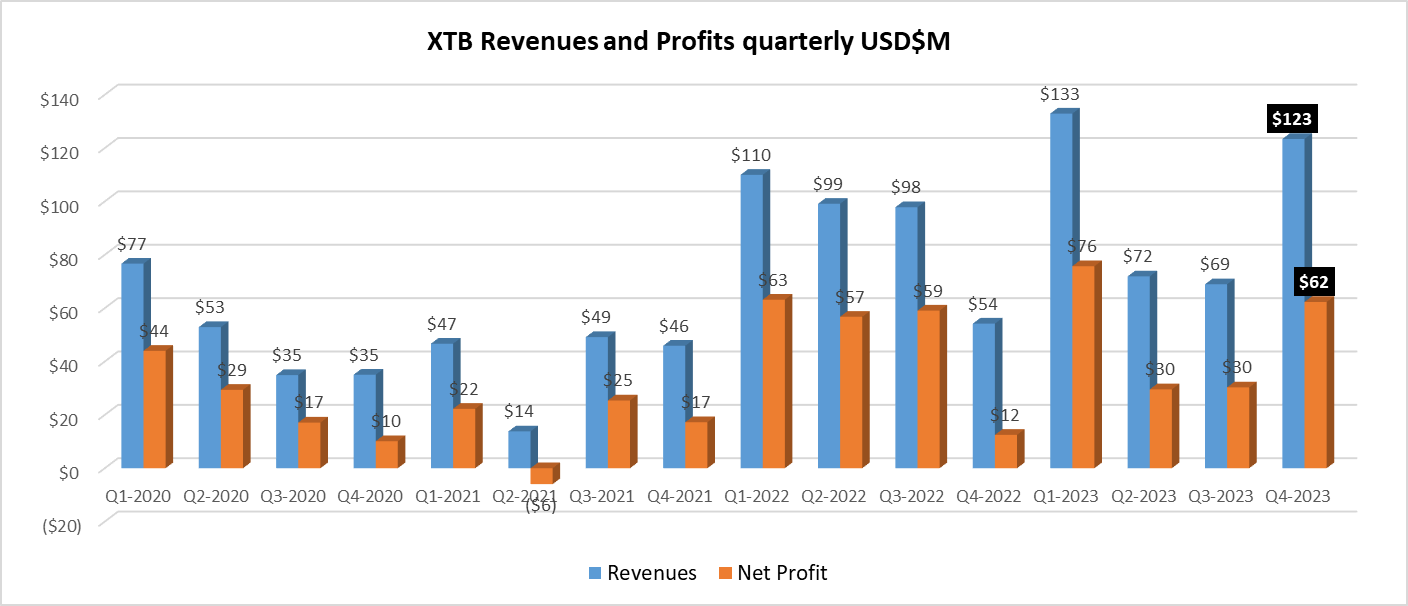

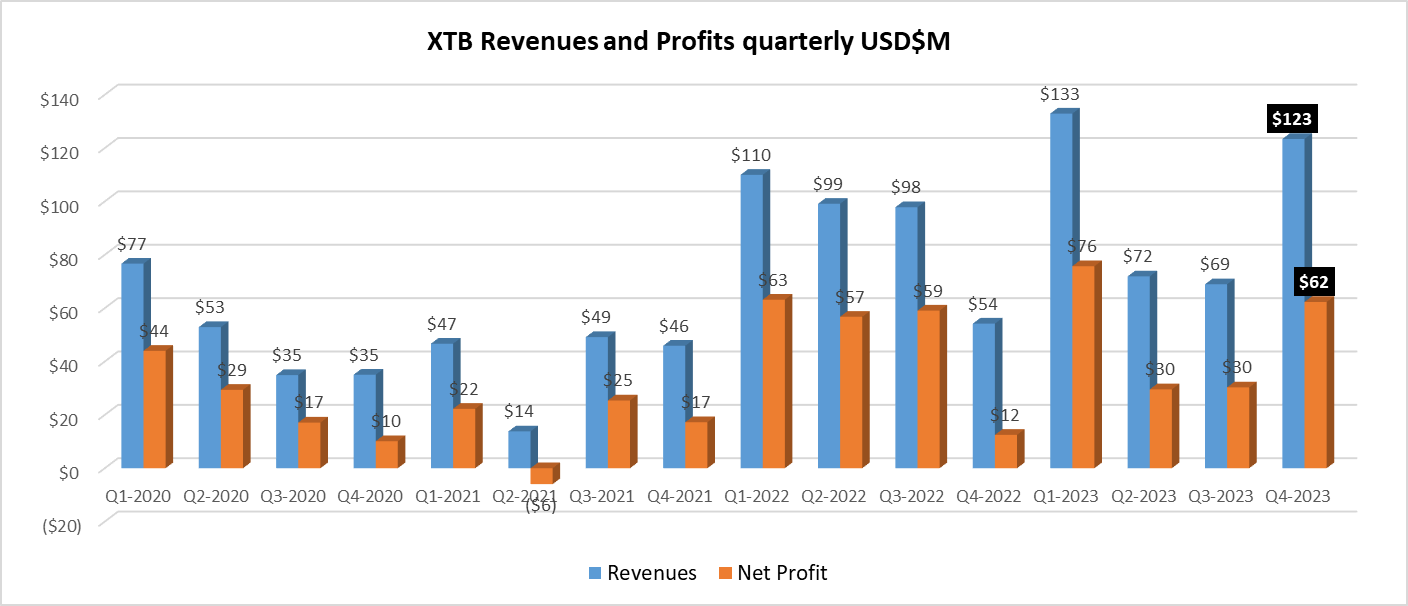

Poland-based Retail FX and CFDs brokerage group XTB SA (WSE:XTB) closed out a record year for both revenue and earnings in 2023, reporting very strong results for the fourth quarter of the year.

In the fourth quarter, XTB saw a 79% QoQ increase in revenue to $123 million and a 106% QoQ jump in net profit to $62 million. Q4 2023 was XTB’s second best quarter ever, second only to this year’s Q1.

Overall for 2023, XTB reported record revenue of PLN 1.59 billion ($397 million) – up 10% from 2022 – and net profit of PLN 791 million ($198 million), up 3% from 2022.

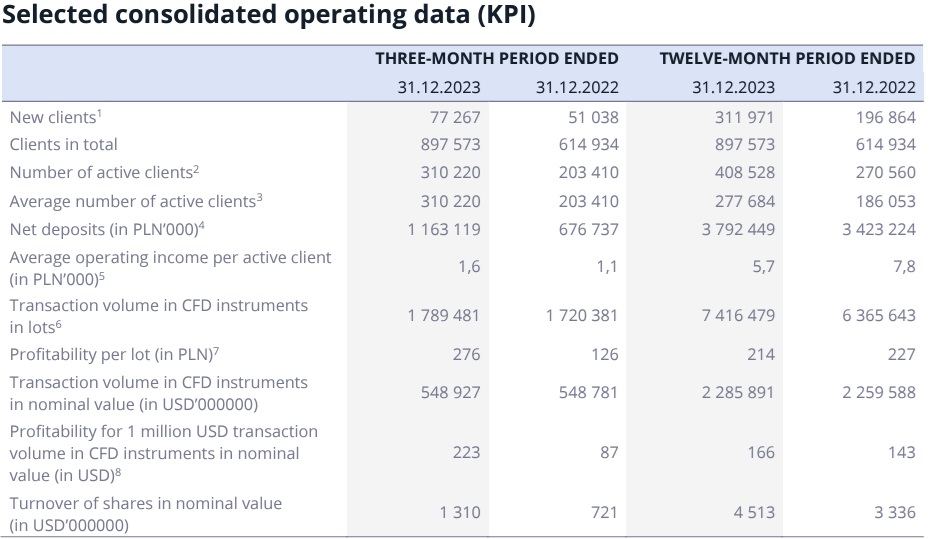

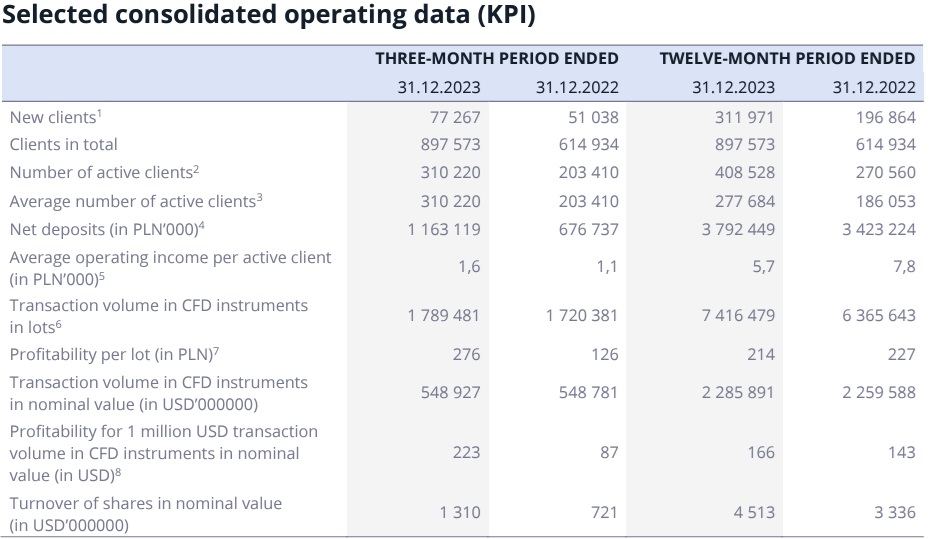

In the fourth quarter, XTB averaged $183 billion in monthly trading volumes. For the entire year 2023, monthly trading volumes in XTB averaged $190 billion.

XTB’s board stated that the year 2023 was a further period of dynamic business development and customer base building for XTB. Continued volatility in financial and commodity markets and a high inflationary environment meant that trading financial instruments continued to be a very attractive proposition for many investors. As a result, the Group acquired a record 312 thousand new customers and the number of active customers increased by 51% annually from 270.6 thousand to 408.5 thousand. XTB’s dynamic operational growth, combined with favorable market conditions, led to record financial results for the year 2023, as noted above.

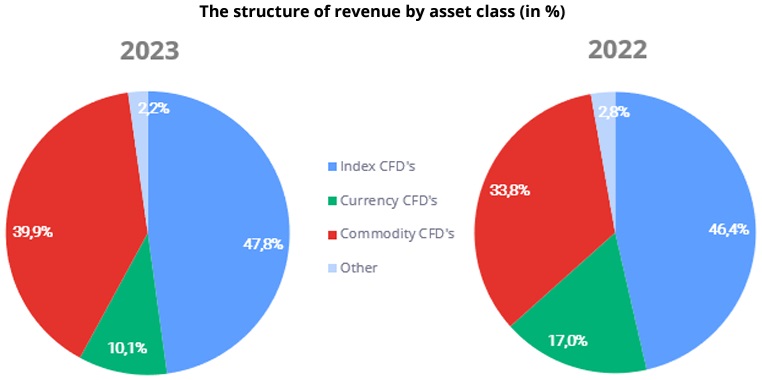

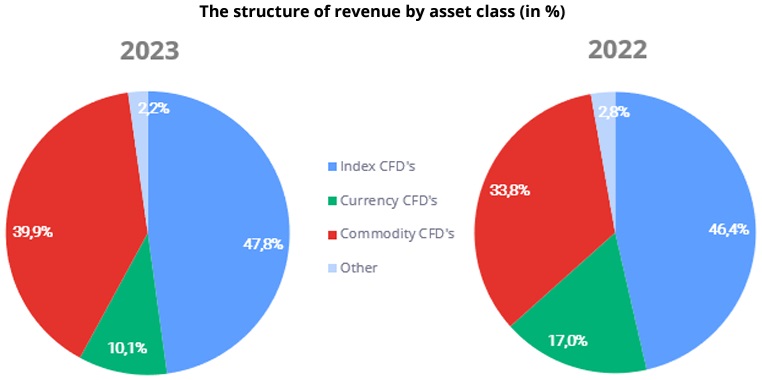

Looking at XTB’s revenue in terms of the categories of instruments they are responsible for producing, it can be seen that in 2023 index-based CFDs were pioneers. Their share in the structure of income from financial instruments amounted to 47.8% against 46.4% in the previous year. This was due to the high profitability of CFD instruments based on the US 100 index, the German DAX index (DE30) and the US 500 index. The second most profitable asset class was Commodity based CFDs. Their share in the revenue structure in 2023 was 39.9% (2022: 33.8%). This is due to the high profitability of CFD instruments based on natural gas, gold and oil prices. Revenue from currency-based CFDs accounted for 10.1% of total revenue, compared to 17.0% last year, with the most profitable financial instruments in this category being CFDs based on the EURUSD and USDJPY currency pairs.

The business model used by XTB combines the features of the agency model and the dealer model, in which the company is a party to transactions entered into and initiated by customers. XTB does not participate, in the strict sense, in transactions carried out on its own account in anticipation of changes in the prices or values of the underlying instruments (proprietary transactions).

Looking ahead, XTB management stated that as a result of XTB’s rapid growth, it estimates that Total operating expenses in 2024 could be as much as a quarter higher than those seen in 2023. The Board’s priority is to continue to grow its customer base and build the global brand. As a result of ongoing activities, marketing expenses could increase by about a third compared to last year.

The Board’s priority is to continue to grow the customer base, which will strengthen XTB’s position in the global market by reaching the mass customer with its product offering. These activities are and will be supported by a number of initiatives, including the introduction of new products or advertising campaigns. The board’s goal for 2024 is to acquire an average of at least 65-90 thousand new customers per quarter. In the first 29 days of January 2024, the Group acquired a total of 27.3 thousand new customers.

Marketing is XTB’s second engine. To strengthen its market position and global visibility, the Group works with successful athletes who are ambassadors of the XTB brand, such as Conor McGregor and Iker Casillas. A new brand ambassador is planned for 2024.

XTB said Social Trading will launch in 2024. Social trading, also called Copy Trading, will allow XTB clients to follow trades made by other users, whose investment strategy they find interesting or impressive. As part of this product, customer data will be anonymized and classified based on their ROI achieved and risk taken.

Regarding overseas expansion in 2024, XTB said it is increasingly boldly building its presence in non-European markets, consistently pursuing the strategy of building a global brand. XTB’s Board of Directors places the main emphasis on organic growth, on the one hand increasing penetration in European markets and on the other hand successively building its presence in Latin America, Asia and Africa. In 2024, the board’s efforts will focus on obtaining the necessary permits and starting operations in Brazil and Indonesia.

The following is selected financial and operating data at XTB for the 4th quarter and for the full year 2023 at XTB.