Poland-based Retail FX and CFDs brokerage XTB SA (WSE:XTB) followed up its record 2023 with an even better start to 2024, reporting record quarterly revenue and near-record profits for the first quarter of the year.

XTB Financial Results Q1 2024

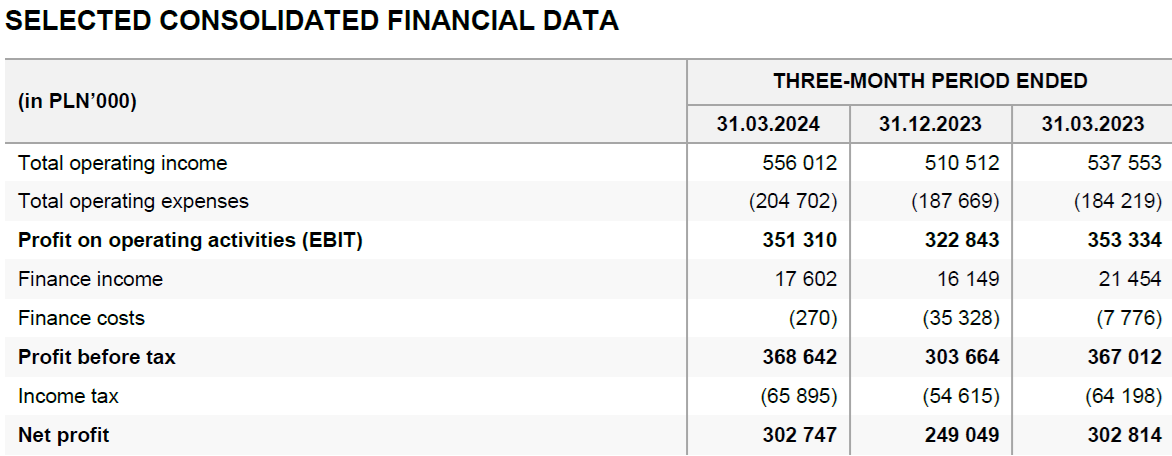

XTB’s revenue reached PLN 556.0 million ($139 million) in Q1 2024, surpassing the company’s previous record of $134 million in the first quarter of last year. Net profit of PLN 302.8 million ($76 million) was well short of the record profits of Q1 2023.

Customer trading volume on XTB averaged $194 billion per month in Q1 2024, slightly higher than the $190 billion per month XTB averaged in 2023.

Management said the first quarter of 2024 was a sequential period of dynamic business growth and customer base building for XTB. Clear long-term trends in the stock and commodity markets have made trading in financial instruments particularly attractive to many investors. As a result, the Group acquired a record 129.7 thousand new customers, an increase of 24.5% year-on-year, while the number of active customers increased by 45.5% year-on-year from 260.1 thousand to 378.5 thousand.

In the first quarter of 2024, XTB reached a record revenue level of PLN 556.0 million, as noted above. Important factors determining the level of income were the high volatility in the financial and commodity markets and the constantly growing number of active clients (increase of 45.5% per year), linked to their high trading activity, expressed in the number of CFD contracts which have been concluded. in batches (increase by 6.5% per annum). Accordingly, the volume of trading in CFD instruments amounted to 1 964.9 thousand lots (Q1 2023: 1 845.2 thousand lots), profitability per lot amounted to PLN 283 (Q1 2023: PLN 291).

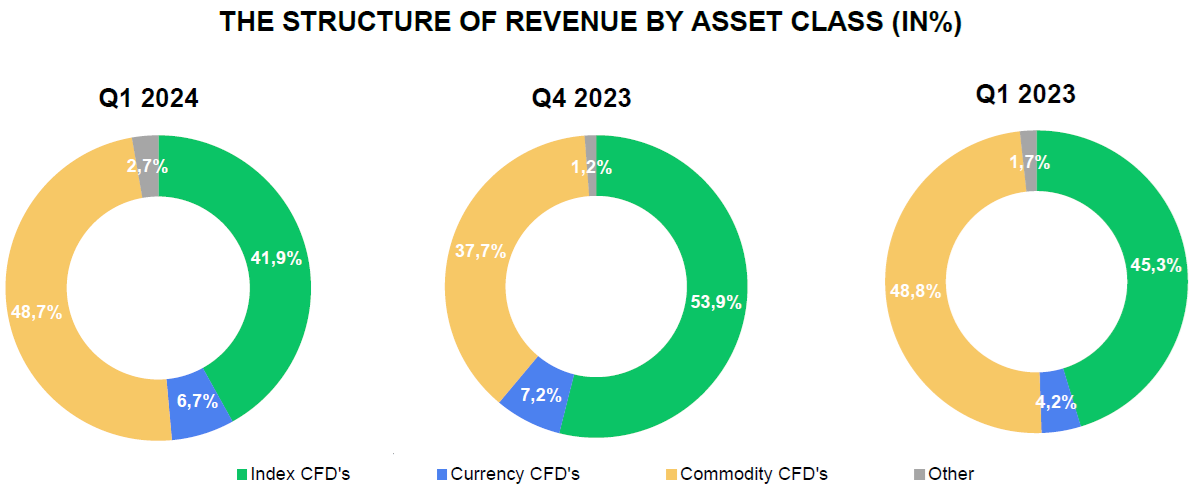

XTB Traded Asset Classes Q1 2024

Looking at XTB’s revenues in terms of the instrument classes responsible for generating them (see chart above), it can be seen that in the first quarter of 2024 commodity-based CFDs led the way. Their share in the revenue structure in Q1 2024 was 48.7% (Q1 2023: 48.8%). This is partly due to the high profitability of CFD instruments based on natural gas, gold and cocoa prices. The second most profitable asset class was CFD based on indices. Their share in the structure of income from financial instruments amounted to 41.9%, compared to 45.3% a year earlier. This is a consequence of the high performance of CFDs based on the German stock index DAX (DE30), the US 100 index or the US 500 index. Revenue from currency-based CFD instruments represented 6.7% of total revenue, compared with 4.2% a year earlier. The most profitable financial instruments in this category were CFDs based on the cryptocurrency bitcoin and the currency pair USDJPY.

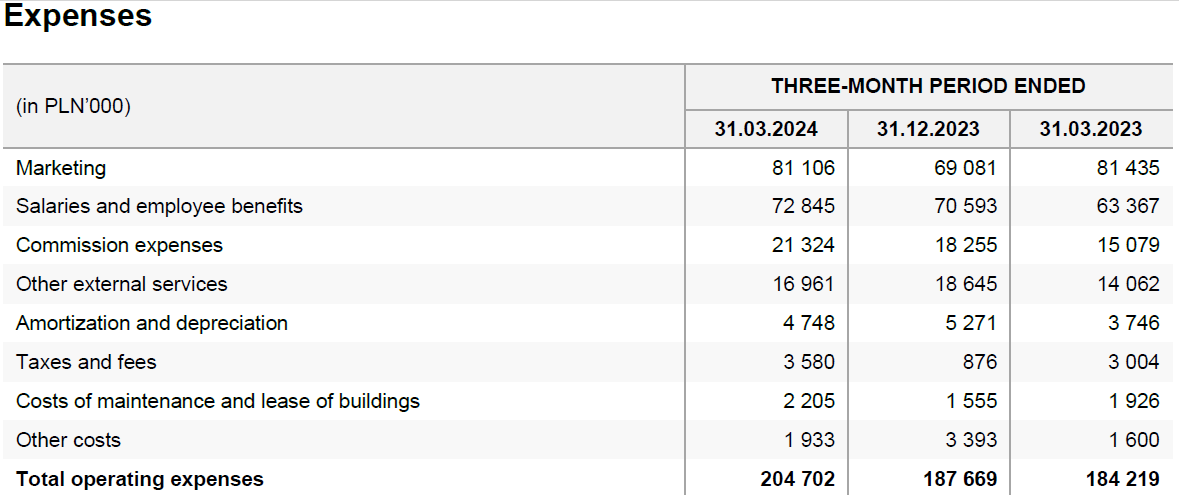

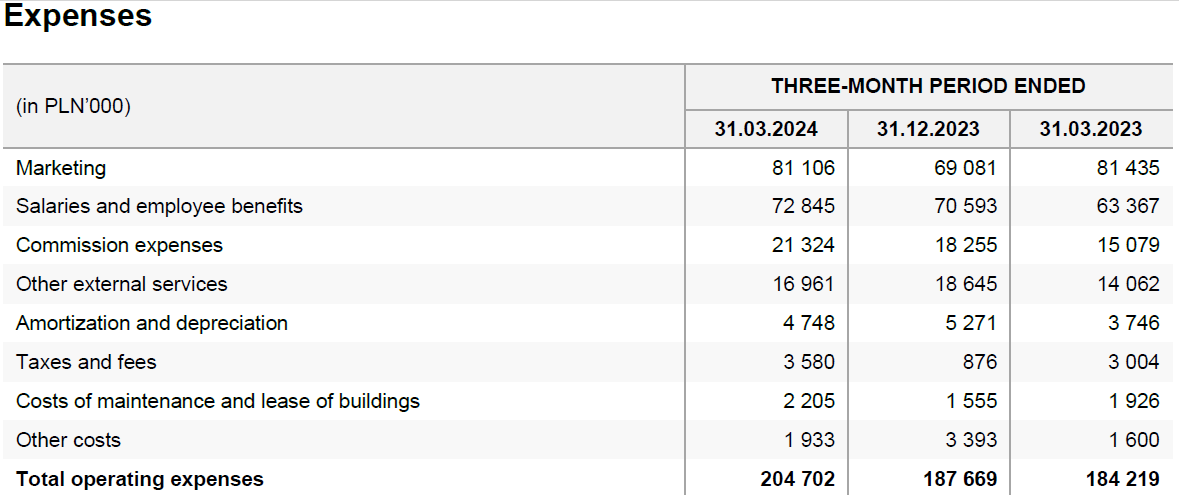

XTB expenses Q1 2024

XTB’s operating costs in the first quarter of 2024 amounted to PLN 204.7 million and were PLN 20.5 million higher compared to the same period last year (Q1 2023: PLN 184.2 million). The most significant changes occurred in:

- fee expenses and employee benefits, an increase of PLN 9.5 million, mainly due to the increase in employment;

- commission costsan increase of PLN 6.2 million resulting from higher amounts paid to payment service providers through which customers deposit their funds into transaction accounts;

- other external servicesan increase of PLN 2.9 million mainly as a result of higher costs for support database systems (an increase of PLN 3.1 per year).

Due to the dynamic growth of XTB, the board of directors estimates that in 2024 the total cost of operating activities may be even higher by about a quarter compared to the level observed in 2023. The priority of the board of directors is to further increase the customer base and building a global brand. As a consequence of the implemented activities, marketing expenditure may increase by approximately one-fifth compared to the previous year.

XTB customer base

The Board said its priority is to continue to grow the customer base, which will strengthen XTB’s position in the global market by reaching the mass customer with its product offering. These activities are and will be supported by a number of initiatives, including the introduction of new products or advertising campaigns. The board’s goal for 2024 is to acquire, on average, at least 65-90 thousand new customers per quarter. As a result of the actions implemented, the Group acquired in the first quarter of this year 129.7 thousand new customers, while in the first 28 days of April 2024, 33.2 thousand new customers were acquired.

XTB’s plans for 2024

Looking ahead, in late 2024 XTB plans to launch a product that will accelerate its transformation into an “everyday platform” for managing personal finances. The virtual wallet and a multi-currency card will allow XTB customers to make instant local payments, transfers, card transactions and currency exchange. Thanks to this product, customers will be able to make instant payments between their XTB accounts. Real-time alerts will support financial control and expense management.

XTB and overseas expansion

XTB, with its strong market position and dynamically growing customer base, is increasingly boldly building its presence in non-European markets, consistently following the strategy of creating a global brand. XTB’s Board of Directors places the main emphasis on organic growth, on the one hand increasing penetration in European markets and on the other hand successively building its presence in Latin America, Asia and Africa. Following these actions, the composition of the capital group may be expanded with new subsidiaries. It is worth noting that geographical expansion is a process carried out by XTB on an ongoing basis, the results of which spread over time. Therefore, we should not expect sudden, sharp changes in the Group’s results.

In 2024, the board’s efforts will focus on obtaining the necessary permits and starting operations in Brazil and Indonesia.