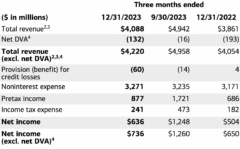

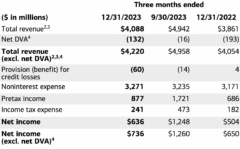

Bank of America today released its financial report for the last quarter of 2023, with Global Markets net income of $636 million.

The Global Markets segment saw sales and trading revenue increase 3% to $3.6 billion, including net charge-off valuation adjustment (DVA) losses of $132 million. Fixed income, currencies and commodities (FICC) revenues fell 4% to $2.1 billion and equity revenues rose 13% to $1.5 billion

Global Markets posted record full-year sales and trading revenue of $17.4 billion.

Across the board, Bank of America reported net income of $3.1 billion, or $0.35 per diluted share, compared to $7.1 billion, or $0.85 per diluted share, in the fourth quarter of 2012.

Adjusted net income for the final quarter of 2023 was $5.9 billion, while adjusted diluted earnings per share were $0.701.

Net interest income was $22.0 billion, down $2.6 billion, or 10%. excluding the impact of BSBY’s discontinuation, adjusted revenue was down 4%.

President and CEO Brian Moynihan commented:

“We reported solid fourth-quarter and full-year results as all of our businesses delivered strong organic growth, with record customer activity and digital engagement. This activity led to good loan demand and deposit growth in the quarter and full-year net income of $26.5 billion. Cost discipline has allowed us to continue to invest in growth initiatives. Our strong capital and liquidity levels enable us to continue to deliver responsible growth in 2024.”